Financial hardship often forces clients into a painful balancing act. During economic downturns or personal financial crises, this scale tips even more dramatically, to the extent that your clients may have to make decisions that will impact their health negatively.

It’s no coincidence that lower socioeconomic status has a strong positive correlation with increased risk for illness – from psychiatric illness to kidney, metabolic, and nervous system disorders.

As a dedicated healthcare practitioner, you strive to empower clients to manage their health in the best way possible.

But,

If you’ve been working as a healthcare professional for a while, you’ll likely have come across clients who are unable to pay for the treatment they need.

As noted on PsycomPro, when healthcare practitioners don’t manage billing well, it can undermine the treatment relationship as well as cause practical business problems.

Thankfully, there are some simple strategies that can be employed to help you navigate difficult scenarios so that your clients are better able to make healthcare a priority during financial hardship.

Stay with us as we explore the options.

1. Set Expectations From the Start

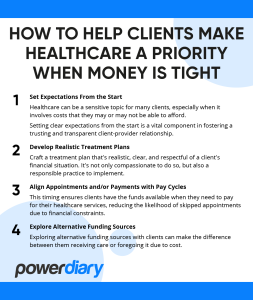

Healthcare can be a sensitive topic for many clients, especially when it involves costs that they may or may not be able to afford.

Setting clear expectations from the start is a vital component in fostering a trusting and transparent client-provider relationship.

Here’s how and why it’s important.

Initial Consultation(s)

Open dialogue about the costs of treatment plans allows clients to understand what they’re committing to, financially and medically.

Transparent communication can build a sense of trust between healthcare professionals and clients, and it underscores the provider’s commitment to client care rather than just the bottom line.

Proactive Communication in Building Trust

Prevent uncomfortable surprises by proactively addressing the financial aspects of treatment. It reduces the chances of non-compliance due to cost and helps establish trust through candid communication.

This conversation can create the opportunity to explore alternative treatment options or financial assistance programs that might be available.

Flag Clients in Your Practice Management System

For clients identified as potentially facing financial challenges, flagging their profile in your practice management system can be a prudent step.

This action helps remind your staff to have sensitive and comprehensive discussions about costs, payment options and potential financial assistance.

Map Out a Plan

This can be a game-changer in client care. Map out a detailed plan – including the treatment path, anticipated costs and a payment schedule.

Planning enables clients to prepare financially and mentally for what lies ahead. By treating payment as an integral part of the treatment plan rather than an afterthought, healthcare providers send a strong message to clients that they are committed to transparency and are empathetic to the client’s situation.

Ideally,

This plan should be revisited and updated as the treatment progresses, taking into account any changes in the client’s circumstances or treatment plan.

2. Develop Realistic Treatment Plans

Craft a treatment plan that’s realistic, clear, and respectful of a client’s financial situation. It’s not only compassionate to do so, but also a responsible practice to implement.

Here are some key steps to consider:

Identify Clear Treatment Goals

Clients are more likely to invest in a treatment plan they perceive as valuable and efficient.

Have open discussions with clients about what’s achievable within their budget, and outline focused and concise goals by making the most critical aspects of care a priority within this framework.

What Are the Key Things That You Can Offer?

Consider how you can retain clients while providing value and efficiency under budget constraints.

Some ideas include:

- Telehealth services – all the more possible using an interface such as the one hosted by Power Diary

- Discounted sessions

- Sliding-scale fees

- Exercises or care strategies that clients can manage at home to reduce the number of required appointments

- Multi-modal treatment strategies that target several issues at once

Look at Appointment Spacing

Avoid setting up a schedule that’s too burdensome on a client’s budget or time.

As the client progresses through their treatment plan, consider (if ethical and feasible) transitioning their appointment schedule into a maintenance phase with less frequent appointments.

3. Align Appointments and/or Payments with Pay Cycles

Managing healthcare costs becomes more achievable when clients can align their appointment and payment schedules with their income cycles.

This timing ensures clients have the funds available when they need to pay for their healthcare services, reducing the likelihood of skipped appointments due to financial constraints.

From a practical standpoint,

During the proactive discussions that take place in your initial session, you can ask clients about their pay cycles and suggest scheduling appointments accordingly.

For example, if a client is paid bi-weekly, appointments can be set up to coincide with these paydays, making it easier for clients to manage their healthcare expenses in tandem with their income.

Get Clients to Make Online Pre-Payments

Encourage clients to pre-pay for their appointments online, based on their pay cycle, even if this doesn’t align perfectly with their appointment schedule.

This practical step allows clients to allocate healthcare funds when available; this simplifies their cash flow planning and helps them avoid the stress of coming up with payment at the time of an appointment.

By aligning healthcare expenses with income, clients are empowered to budget for their health more effectively.

It turns healthcare expenses into a planned, expected item in the budget rather than an unpredictable stressor.

4. Explore Alternative Funding Sources

Exploring alternative funding sources with clients can make the difference between them receiving care or foregoing it due to cost.

Look at Alternative Funding Sources

Make your clients aware of all the funding options that might be available to them.

This could include insurance coverage, Medicare, Employee Assistance Programs (EAPs), local charity programs, or sliding scale fees your practice may offer based on income.

Having a backup plan can be invaluable if a client’s budget runs out.

Encourage Your Staff to Initiate Discussions About These Options Early in the Treatment Process

Instead of dealing reactively with no-show fees and disrupted treatment plans when a client can no longer afford care, initiate these discussions early, as knowing there are options can relieve client stress and help prevent interruptions in care.

For example, a provider might say at the first appointment, “Let’s talk about how you plan to manage the costs associated with your treatment. If it becomes a challenge at any point, we have options we can explore together.”

Highlight the Potential of Involving Clients’ Support Networks

Family members and community networks can play a significant role in helping clients navigate financial challenges.

If appropriate, encourage the client to engage these support networks to open doors to financial assistance, whether that’s direct support from family or friends, or assistance in researching and applying for third-party funding options.

For instance, a family member might help a client research local charities that provide grants for healthcare expenses, or they might contribute directly to the client’s healthcare fund.

Conclusion

In healthcare, clear and open discussions about payment are as critical as conversations about treatment options.

When you initiate payment strategies at the outset of treatment, you set a precedent for transparency, avoid last-minute payment issues, and underscore that client care is the foremost concern – especially in challenging financial times.

Consider leveraging practice management tools like Power Diary, which offers automatic appointment reminders, client alerts, easy paperless invoicing, and an online Client Portal for streamlined appointment management and online payments.

Start your FREE TRIAL with Power Diary today – no credit card required!