For allied health practitioners, the beginning of a new financial year represents an opportunity to set the tone for the months ahead. It’s a time to evaluate past performance, integrate necessary changes for your practice and brainstorm for your future.

In this article, we’ll discuss a few preparation strategies to keep in mind.

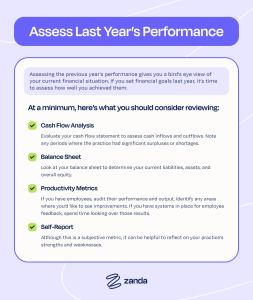

1. Assess Last Year’s Performance

This gives you a bird’s-eye view of your current financial situation. If you set financial goals last year, it’s time to assess how well you achieved them.

At a minimum, here’s what you should consider reviewing:

- Cash flow analysis: Evaluate your cash flow statement to assess cash inflows and outflows. Note any periods where the practice had significant surpluses or shortages.

- Balance sheet: Look at your balance sheet to determine your current liabilities, assets and overall equity.

- Productivity metrics: If you have employees, audit their performance and output. Identify any areas where you’d like to see improvements. If you have systems in place for employee feedback, spend time looking over those results.

- Self-report: Although this is a subjective metric, it can be helpful to reflect on your practice’s strengths and weaknesses. What went well? What could you have done better? How do you want to incorporate this information to move forward?

2. Define Concrete Financial Goals

It’s essential for health practice owners to establish financial benchmarks. These goals may be weekly, monthly, quarterly or annual. It’s generally best to have a mix of both short-term and long-term goals.

Here are a few things to consider:

- Identify all business liabilities: Assess all debts, including credit card debt, open credit lines, personal loans and business loans. You should know the exact debt figure.

- Consider setting SMART Goals: SMART is an acronym that stands for ‘specific, measurable, achievable, relevant and time-bound.’ For example, “Within the next six months, I’ll be earning, on average, $10,000 per month.”

- Use budgeting tools: Budgeting tools help you track all incoming revenue and both fixed and variable expenses. Budgeting can help you better assess where you can spend, and where you need to cut back.

- Meet with a financial advisor: If you feel overwhelmed by your practice’s finances, consider meeting with a professional advisor. They can offer valuable guidance about improving cash flow, budgeting, investing and more.

3. Ensure Optimal Tax Planning and Tax Compliance

Although it’s possible to DIY your practice’s taxes, many people find it’s much simpler to work with a tax professional. You want to ensure your business adheres to all tax laws and benefits from all relevant claims and deductions. Based on your specific practice structure, tax planning can be fairly nuanced.

However, here are a few general considerations:

- Estimate relevant tax liabilities: Ensure that all quarterly estimated tax payments are paid accurately and on time to avoid penalties.

- Year-end inventory: Conduct a physical inventory count to reconcile this figure in your books.

- Superannuation contributions: If, as a sole trader, you’ve put aside regular superannuation contributions, you may be able to claim a tax deduction. If you have employees, you’ll also want to ensure you’ve paid correct superannuation payments.

- Charitable contributions: Determine if you want to make charitable donations before the annual deadlines.

- Tax law changes: Work with your accountant to stay current on any changes in tax laws; including payroll taxes, claims and contribution amounts.

4. Review Insurance Plans and Coverage

It’s a good idea to assess your insurance annually to ensure you and your practice are appropriately covered.

Here’s a checklist to help keep you on track:

- Review all existing plans: Double-check that all coverage limits appropriately suit your business’s needs. Consider whether it’s beneficial to lower or raise your deductibles.

- Policy exclusions: Make sure you fully understand what isn’t covered (and determine if you need supplemental coverage elsewhere).

- Make any updates: If you’ve changed locations, dramatically increased or decreased revenues, added more employees or services, you may need to update the policy plans.

- Shop around: If you want to save money on insurance, obtain quotes from different providers to review your options. It may be best to work with a professional broker. Some insurance companies offer discounts for bundling services together.

5. Strengthen Overall Cash Flow

Improving cash flow is non-negotiable for any successful health practice owner. Increasing revenue helps provide stability for your business, and it offers necessary leverage during leaner times.

Here are a few points to consider:

- Business emergency fund: If you don’t have emergency savings in place, make building this nest egg a priority. Ideally, your fund should contain enough cash that it could cover at least 3-6 months of your practice expenses.

- Improve your invoicing system: Consider implementing an automatic invoicing system or commit to sending invoices immediately after rendering services to help ensure timely billing.

- Follow-up on late payments or overdue invoices: Ensure you’re staying on top of any late payments. Have procedures in place for late cancellations, no-shows and collecting on outstanding invoices.

- Cash flow projections: Practice owners may find it helpful to project cash flow amounts for the next 3-6-12 months based on past data and anticipated income or expense changes.

- Increase rates: Audit your current rates to determine if it’s time to raise fees (or make a plan to raise fees).

- Commit to monthly financial reviews: It’s a good idea to commit to monthly reviews of your cash flow. If this feels like too big of a task to do on your own, ask your accountant to send you a monthly profit-and-loss statement to review.

By keeping these strategies in mind, allied health practice owners can take steps to effectively prepare, manage and project their financial needs. Consider creating an end-of-year financial checklist to refer to annually. It will help ensure you stay on top of your practice’s financial health, and allow you to intervene before there’s a serious problem.

Stay on top of your practice finances with Zanda. Our all-in-one practice management system includes automated invoicing and payment reminders, comprehensive reports, integration with accounting software and much more. Start your 14-day free trial today, no credit card required!