Searching “What does Medicare cover for home health care” opens a floodgate of information. It can be overwhelming and confusing and, unfortunately, often generates more questions than answers.

We’ve broken this important question down into a series of frequently asked questions, looking at what home health services can be offered by a home health agency, what services aren’t covered, and who qualifies.

If you’re a health professional looking to start a home health agency or trying to navigate Medicare’s coverage rules, you’re in the right place.

What is Home Health Care?

Home health care includes a wide range of health services administered in a client’s home following an illness or injury.

It’s a practical, convenient, and cost-effective alternative to hospital or clinic care.

Also known as home care, supportive care, or in-home care, these services are delivered by qualified professionals, ensuring clients get the care they need without leaving their homes.

What Home Health Services Does Medicare Cover?

Medicare Part A (hospital insurance) and Part B (medical insurance) cover a range of home health services, including:

- Medically necessary skilled nursing care (part-time or intermittent)

- Wound care for pressure sores or surgical wounds

- IV or nutrition therapy

- Injections

- Monitoring serious illness and unstable health conditions

- Patient and caregiver education

- Part-time or intermittent home health aide care (if you’re also getting skilled nursing care, physical therapy, speech-language pathology services, or occupational therapy at the same time)

- Bathing and grooming assistance

- Help with walking

- Changing bed linens

- Feeding support

- Other Covered Services and Equipment

- Injectable osteoporosis drugs for women

- Durable medical equipment

- Medical supplies for home use

- Disposable negative pressure wound therapy devices

What Isn’t Covered?

Medicare won’t cover 24/7 home care or meal deliveries.

It also won’t pay for homemaker services (like cleaning or laundry) or personal care (such as bathing and dressing) if those are the only services a client needs.

Medicare home health coverage is about medical necessity – if a service isn’t tied to a skilled medical need, it’s likely not covered.

How Do You Become a Certified Home Health Provider?

A Home Health Agency (HHA) follows policies set by an associated group of medical professionals (including one or more physicians and registered professional nurses).

You’ll also need to:

- Maintain accurate clinical records

- Obtain the necessary state licensing

- Meet federal health and safety requirements

Who’s Eligible for In-Home Care?

To qualify for Medicare-covered home health care Part A or Part B, your client must meet the following conditions:

- Doctor Supervision: They must be under a doctor’s care, with regular case reviews.

- Medical Necessity: Their doctor must certify that they need skilled nursing care or therapy.

- Temporary Therapy Needs: They must require physical, occupational, or speech therapy for a limited time.

- Housebound Status: Leaving their home requires significant effort or assistance.

- Doctor Certification: A doctor must confirm their housebound status based on a documented visit no more than 90 days before or 30 days after home care begins.

- Plan of Care: Their doctor must establish and regularly review a care plan detailing needed services, frequency of services, who will provide services, required supplies, and expected outcomes.

- Part-Time Skilled Nursing: They must only require part-time skilled nursing care (excluding blood draws).

- Certified Provider: Your home health agency must be Medicare-certified.

Medicare won’t cover home health benefits if a client needs more than intermittent skilled nursing care. However, they can still leave home for medical treatment, for short outings such as religious services, or to attend adult daycare without losing eligibility.

For more details, visit Medicare’s website.

How Much Does Medicare Cover for Home Health Care?

If your client has original Medicare, they don’t pay anything for home health services, although they will be liable for a co-pay of 20% of the Medicare-approved amount for durable medical equipment (such as wheelchairs, hospital beds, crutches, walkers, kidney machines, ventilators, oxygen, monitors, and pressure mattresses).

Before starting with home health care, you, as the agency, will need to advise your client what costs will be incurred and which are covered by Medicare. You’ll also need to inform them of any services that aren’t covered by Medicare. This should be communicated in person and in writing, and you’ll also need to provide them with an “Advance Beneficiary Notice” before any non-Medicare services are provided.

Checking Coverage in Advance

In some states (including Florida, Michigan, Illinois, Massachusetts, and Texas) you may submit a pre-claim review request to Medicare. This helps you and the client determine whether Medicare is likely to cover the services.

What Affects Out-of-Pocket Costs?

The specific amount a client will owe for non-Medicare covered services will depend on:

- Any other medical insurance they have;

- Their doctor’s rates;

- If their doctor accepts assignment;

- The type of treatment facility;

- Where they get their tests or services.

In some cases, your client’s doctor may recommend a treatment plan that requires more regular treatments than are covered by Medicare, or they may recommend services that aren’t covered. If this happens, the client will be liable for the costs.

Is Skilled Nursing Care Covered?

Yes, but only on a part-time (intermittent) basis.

Medicare covers skilled nursing care if it’s:

- Provided fewer than 7 days a week or less than 8 hours a day

- Needed for no more than 21 days (extensions may be granted if a doctor confirms an end date)

Skilled nursing care helps clients recover from illness or injury, with licensed nurses providing medical treatments like wound care, injections, and catheter changes.

What Home Health Services Do Aides Provide?

Home health aides help with personal care tasks like dressing, bathing, and using the bathroom if clients need these services following an injury or illness. Medicare only covers these services if the client is also receiving skilled nursing or therapy.

When Does Medicare Cover Physical, Occupational, or Speech Therapy?

Physical therapy will be covered by Medicare when it will help the client regain strength or movement after an illness or injury. The same holds true for occupational therapy, where the goal is to restore functionality, and for speech therapy to help patients relearn how to communicate.

The services will only be covered if they are expected to result in an improvement within a predictable period of time. Additionally, the frequency, duration, and number of services must be reasonable and provided by a qualified therapist. To be eligible for the services, the client’s condition must either:

- Be expected to improve,

- Require a maintenance program from a skilled therapist, or

- Require a skilled therapist for maintenance.

Professional therapists will restore or improve the client’s ability to perform routine everyday tasks, speak, or even walk following an illness or injury. They may also help prevent a condition from worsening and will only be covered if the services specifically, safely, and effectively treat the client’s condition.

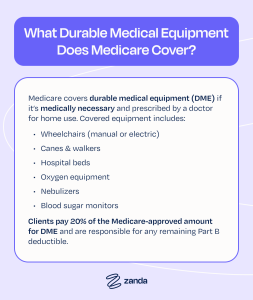

What Durable Medical Equipment Does Medicare Cover?

Medicare covers the cost of durable medical equipment (DME) if it’s deemed medically necessary and prescribed by a doctor for home use. Covered equipment includes:

- Wheelchairs (manual or electric)

- Canes & walkers

- Hospital beds

- Oxygen

- Nebulizers

- Blood sugar monitors

Clients pay 20% of the Medicare-approved amount for DME and are responsible for any remaining deductible under Medicare Part B.

What Are Medical Social Services?

These are medically prescribed services to help the patient cope emotionally in the aftermath of an illness or disease. Examples of medical social services that Medicare covers include in-home counseling by a licensed therapist or social worker. Keep in mind that these services are only covered by Medicare if the client is receiving skilled nursing care at home.

Helping Your Clients with Medicare Home Health Care

If you have clients with Medicare insurance who require home health care, there is a range of services that you may be able to offer to help with an injury or illness. Where possible, it’s ideal to get a pre-claim review request for a full breakdown of what you can expect Medicare to cover for your client.

This article was originally published in 2020 and has been updated for comprehensiveness and accuracy.