The numbers don’t lie; unexpected medical bills can have a detrimental impact on a client’s finances, especially in the United States, where healthcare can be cost-prohibitive and is the leading cause of bankruptcy. To help address this issue, the United States Congress passed the No Surprises Act in 2021.

This act includes a provision about good faith estimates, which refers to a clear outline of costs for clients privately paying for healthcare services. Ideally, this legislation protects clients from receiving surprise bills when using out-of-network services or when unknowingly working with out-of-network providers.

If you’re an individual provider or work for a health practice treating private pay or out-of-network clients, you’ll be sending these estimates. Let’s get into what you need to know!

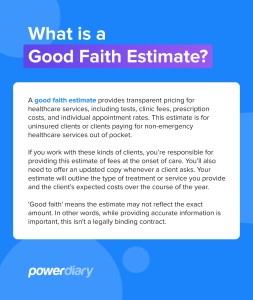

What is a Good Faith Estimate?

A good faith estimate provides transparent pricing for healthcare services, including tests, clinic fees, prescription costs, and individual appointment rates. This estimate is for uninsured clients or clients paying for non-emergency healthcare services out of pocket.

If you work with these kinds of clients, you’re responsible for providing this estimate of fees at the onset of care. You’ll also need to offer an updated copy whenever a client asks. Your estimate will outline the type of treatment or service you provide and the client’s expected costs over the course of the year.

‘Good faith’ means the estimate may not reflect the exact amount. In other words, while providing accurate information is important, this isn’t a legally binding contract.

What Information Should a Good Faith Estimate Include?

A good faith estimate is a document that must be accessible in the language spoken by the client.

This estimate needs to include each of the following items:

- The client’s name and date of birth

- A concise explanation of services written in easy-to-comprehend language

- An itemized breakdown of any additional goods or services that may be offered alongside the primary services

- Diagnostic codes, service codes, and expected costs of each good or service

- The clinician’s full name, NPI, and tax ID number (TIN) of each provider or facility

- Service office location

In addition, the estimate also needs to include the following disclaimers:

- The acknowledgement that good faith estimates are estimates, meaning the exact costs may differ.

- The reminder that clients have a right to dispute charges if the actual billed costs significantly exceed the expected charges listed in the good faith estimate.

- The acknowledgement that the good faith estimate is not a contract and does not require that the client obtain the goods or services from that provider or organization.

Who is Required to Provide Good Faith Estimates?

All healthcare practitioners and medical organizations in the United States must provide good faith estimates for uninsured or self-pay clients who opt out of using their insurance for healthcare costs. If you treat clients like this, you’re responsible for providing a good faith estimate.

The estimates are typically annual, so your total fee will reflect the expected costs of 12 months of services.

For example, your good faith estimate for therapy may indicate:

“I expect you will engage in continued weekly therapy sessions for depression treatment for the rest of this year at $150 per session for a total of 48 weeks, accounting for holidays for an estimated cost of $7,200.”

At this time, good faith estimates aren’t required for individuals using health insurance to pay for treatment. The legislation also does not apply to Medicare, Medicaid, or other federal healthcare program participants. However, this may change in the future.

Although estimates don’t need to be perfect, they should be reasonable. Keep in mind that failing to offer an accurate good faith estimate may result in penalties. Clients have the right to dispute their charges via the patient-provider dispute resolution (PPDR) if actual treatment costs are at least $400 above the charges outlined in their good faith estimate.

When Should a Good Faith Estimate be Provided to Clients?

There are a few logistics to consider when sending clients good faith estimates:

- If the planned service is scheduled 10 or more business days in advance, send the good faith estimate no later than 3 business days from the scheduling date.

- If the service is scheduled 3-9 business days before the appointment date, provide the good faith estimate within 1 day of the scheduling date.

To keep things simple, many providers include these estimates with their standard intake forms. You can streamline the creation and delivery of forms with good practice management software.

Remember that clients have the right to ask for a good faith estimate at any time. If someone requests an estimate, it’s important to provide such documentation no later than 3 business days after their request.

If there is a financial change in services (such as your raising or decreasing rates or changes in treatment frequency), make a plan to send revised good faith estimates to clients to reflect your adjustments.

Conclusion

Good faith estimates provide clients with a transparent understanding of the expected costs associated with treatment services. This helps people make informed decisions about their healthcare, which may reduce financial stress and promote enhanced trust with providers.

FAQs

How Do I Explain a Good Faith Estimate to Clients?

Trust is an important component of treatment. It can be beneficial to start by acknowledging that the good faith estimate provides a transparent overview of treatment costs.

Let clients know that this form is intended to help them anticipate upcoming costs and avoid unexpected expenses. Encourage them to ask questions if anything confuses or concerns them.

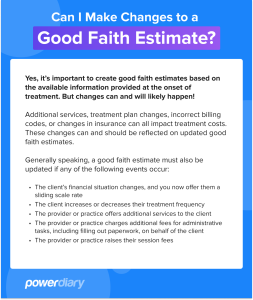

Can I Make Changes to a Good Faith Estimate?

Yes, it’s important to create good faith estimates based on the available information provided at the onset of treatment. But changes can and will likely happen!

Additional services, treatment plan changes, incorrect billing codes, or changes in insurance can all impact treatment costs. These changes can and should be reflected on updated good faith estimates.

Generally speaking, a good faith estimate must also be updated if any of the following events occur:

- The client’s financial situation changes, and you now offer them a sliding scale rate

- The client increases or decreases their treatment frequency

- The provider or practice offers additional services to the client

- The provider or practice charges additional fees for administrative tasks, including filling out paperwork, on behalf of the client

- The provider or practice raises their session fees

What Happens if My Good Faith Estimate Is Incorrect?

It’s important to strive for accuracy when creating good faith estimates for clients. However, you can modify your estimates at any time, so it’s equally important to make necessary changes when new information becomes available.

Under federal law, clients can dispute medical bills if actual costs exceed the cost of services outlined in their good faith estimate by $400 or more. If this occurs, clients can negotiate the bill or seek financial assistance with you directly.

Clients can also start a dispute resolution process with the U.S. Department of Health and Human Services (HHS) within 120 calendar days of the date listed on the original bill. If this happens, providers or practices cannot take any retributive action against the dispute.

To learn more about the dispute process, visit https://www.cms.gov/medical-bill-rights.

Power Diary and Good Faith Estimate Compliance

At Power Diary, we have an extensive library of professional communication templates so practitioners can spend less time developing paperwork and more time focused on what matters most: excellent client care.

You can use our templates to easily create and send good faith estimates to clients. Sign up today to start your 14-day free trial. No credit card required!

Important note from our Legal Eagles: We know you know this, but we need to say it anyway. The information in this article is general in nature and is not legal advice. If you’re unsure of the rules that apply to you, your professional association is often a good place to start.