This article is written by Nicole Arzt, LMFT

At some point, most healthcare providers weigh the benefits and drawbacks of credentialing with insurance panels. Choosing whether to accept insurance is a significant decision that may dramatically affect how you market your practice, obtain clients, and orient your treatment. Some practitioners solely take insurance, whereas others opt for a hybrid model, paneling with a few insurance companies and also accepting cash-pay clients.

Before navigating the credentialing process, it’s important to understand the process, benefits, and potential risks of taking insurance. This is crucial for making an informed decision for your practice. This article offers a comprehensive review of insurance credentialing and includes action-oriented takeaways for getting paneled.

What Are Insurance Panels?

Insurance panels refer to specific insurance companies that offer various medical services at pre-negotiated rates. These rates are generally not advertised to the public. When a provider is in-network with an insurance company, they agree to accept these pre-negotiated rates for service.

Insurance panels are a significant part of the U.S. healthcare system. Because many clients opt to use insurance to pay for certain medical treatments–including therapy–they will often seek to work with an in-network provider. This option tends to be more affordable than working with an out-of-network provider or a provider who doesn’t accept any insurance.

If you join an insurance panel, you must adhere to their specific requirements – this may include various administrative tasks, paperwork, and more. However, you may receive more client referrals than you would marketing solely on your own. That said, the total reimbursement rate tends to be lower than a typical cash hourly rate.

Should I Get Paneled With Insurance Payers?

It’s not a simple yes or no answer. Joining an insurance panel is a nuanced process, and it’s important to be mindful of all the potential pros and cons.

Pros of Getting on Insurance Panels

More client accessibility: Most therapists find that it’s easier to acquire clients when they accept insurance. This is because many clients prioritize using their insurance benefits to pay for some or all of treatment. Therefore, you have a wider reach.

Fewer marketing costs and networking needs: Not all healthcare professionals want to spend time and money advertising their businesses. If you secure more clients through insurance, there tends to be less need for marketing or networking. This can save you both time and money when it comes to building your career.

Steady income: Having consistent referrals and a solid caseload as an in-network provider means you’re likely making a reliable income each month. Even if you might make less than a provider who doesn’t accept insurance, you may also be less likely to have drastic swings in your finances.

Reduced financial issues for clients: Accepting insurance makes your services more affordable to more clients. If inclusivity is a core value of your business, this benefit becomes even more pronounced. By lowering the cost, you promote more accessibility and may increase your ability to retain certain clients over a longer period of time.

Cons of Getting on Insurance Panels

Administrative burden: Credentialing can be a frustrating, time-consuming process. Similarly, you’re responsible for managing insurance claims, verifying benefits, submitting claims in a timely fashion, and dealing with paperwork constraints.

Reduced reimbursement and/or delayed payment: Per hour, you will likely earn less than you would if you didn’t accept insurance. Some panels notoriously pay very low rates and do not allow for negotiation. Furthermore, some companies are known for delaying payment (or even engaging in clawbacks), which can disrupt your overall revenue.

Concerns with compliance and regulations: All insurance companies have specific rules around billing and coding. This may limit some of the inherent freedom associated with running a practice, and you may not agree with all the panel’s policies. However, failing to comply can result in denials, audits, or clawbacks, all of which affect a client’s authorization for treatment and reimbursement.

Potential impact on client relationships: You may not always align with certain insurance requirements. This can create potentially tense dynamics between you and your clients. For example, you might not agree with the need to diagnose a certain client, but the insurance company will often require a diagnosis to authorize care.

How to Get Paneled with Insurance

If you choose to get paneled with insurance, it’s important to prepare yourself in advance. The credentialing process can feel overwhelming and even discouraging. However, getting things organized now can set you up for success.

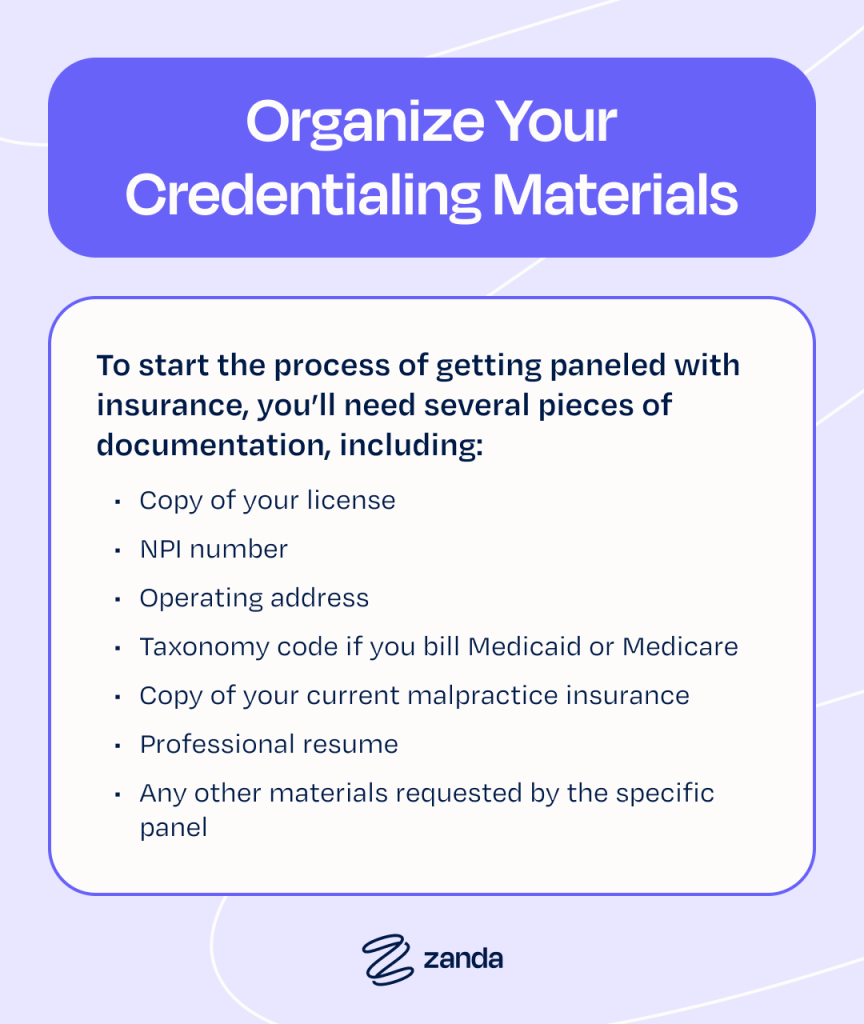

Organize Your Credentialing Materials

To start the process, you’ll need several pieces of documentation, including:

- Copy of your license

- NPI number

- Operating address

- Taxonomy code if you bill Medicaid or Medicare

- Copy of your current malpractice insurance

- Professional resume

- Any other materials requested by the specific panel

Most companies use the Council for Affordable Quality Healthcare (CAQH) to credential their providers. You can either complete the application process on paper or online through the enrollment center at CAQH.org. Make sure you save all application details and respond to any requests for revisions quickly.

Research Insurance Payers Within Your Region

Start looking into which insurance companies contract with healthcare providers in your area. You may want to start with the more popular panels first. You can also ask your colleagues which panels they have found to be either the easiest or most lucrative to work with (depending on your preferences).

Remember that each company has its own requirements and distinct reimbursement rates. For instance, some companies require you to be licensed for a certain number of years before applying for credentialing.

Some panels may be full or not accepting current applications. You may be able to appeal this by changing your services (i.e. increasing your availability) or advertising certain specialties (i.e. offering in-person services or being bilingual).

Finalize and Submit Your Application

You should expect to devote several hours to administrative work per insurance panel. Also, after submitting your application, you may need to follow up on your status. If an application gets stuck, your data may ‘expire,’ and you will have to start the process again. Keep copies of everything you submit on hand.

When approved, make sure you meticulously read through your contract before signing it. You want to be aware of all requirements. From there, you will then need to familiarize yourself with the insurance company’s hub, including its online portal and local directories.

Consider Outsourcing to Save Time

Some outside companies or individual consultants help providers panel with insurance. This may be a beneficial option if you:

- Work full-time but want to start building your own practice

- Already have a robust practice but want to accept more insurance panels

- Feel overwhelmed by the administrative burden associated with paneling

- Want to work with existing companies that have already negotiated competitive rates

Processing Insurance Claims is Easy with Zanda

Choosing to accept insurance is a personal and unique situation for all healthcare providers. The good news is that, no matter what you decide, you’re never permanently locked into one choice. Many professionals opt for a mix-and-match approach; they might accept some insurance-based clients and also see some clients privately. Consider your individual needs and your practice goals when deciding what’s best for you.

Zanda has an in-platform insurance claiming integration that makes working with insurance an easy, straightforward process. Start a 14-day Free Trial of Zanda now and see for yourself!

Nicole Arzt is a licensed marriage and family therapist and author working in private practice in Orange County, CA. Nicole has worked in various settings throughout her career, including hospitals, schools, nonprofit community health clinics, and private practice.